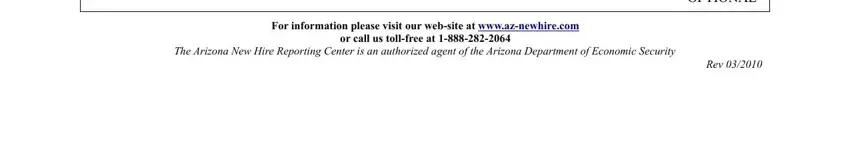

Arizona New Hire Reporting Form

Mail completed form to: Arizona New Hire Reporting Center

P.O Box 402

Holbrook, MA 02343

Or fax completed form to: 1-888-282-0502 toll-free fax

EMPLOYER INFORMATION

Federal Employer Identification Number (FEIN): _______________________________________________________

(Please use the same FEIN for which listed employee(s) quarterly wages will be reported under.)

Employer Name: _________________________________________ DBA: ___________________________________

Contact Name: __________________________ Telephone: _________________ Email: ________________________

Address: _______________________________________________________________________________________

(Please indicate the address where the Income Withholding Order will be sent)

City: _________________________________ State: __________ Zip Code: _________________ +4: _____________

Complete one entry for each new employee

EMPLOYEE INFORMATION

Social Security Number: _____________-_____________-_____________

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

EMPLOYEE INFORMATION

Social Security Number: _____________-_____________-_____________

Employee First Name: __________________________________ Middle: ____________________________________

Employee Last Name: ______________________________________________________________________________

Employee Address: ________________________________________________________________________________

City: ________________________________________ State: ____________ Zip Code: ____________ +4: _________

*Date of Birth: ________________________________ |

*Date of Hire: ___________________________ |

*Is medical insurance an employee benefit? |

Yes ____ |

No ____ |

*Is this employee eligible for an insurance benefit? |

Yes ____ |

No ____ |

* OPTIONAL

For information please visit our web-site at www.az-newhire.com

or call us toll-free at 1-888-282-2064

The Arizona New Hire Reporting Center is an authorized agent of the Arizona Department of Economic Security